Vertical digital solutions for the Consumer Finance sector

Finwave’s highly innovative operating system means it is able to handle the complex management of the lifecycle of personal credit granted to the private consumer segment.

DISCOVER OUR SOLUTIONS

Finwave’s operating system allows a range of specific activities for management of consumer credit and instant lending to be offered, from the application through to the management of the aftersales processes, in a customer-oriented modular manner based on a workflow logic and making use of advanced, high-efficiency technologies which allow for minimization of costs.

Finwave boasts thorough in-depth technical and financial knowledge in the consumer finance sector, supplemented with widespread and consolidated experience of management and administration of consumer credit portfolios, demonstrated by the progressive development of dedicated application systems. These foundations ensure that Finwave meets the set goals successfully and within a limited timeframe.

Why choose Finwave?

The operational approach used by Finwave involves an agile management mode which incorporates the following phases:

- Gathering of requirements

- Analysis and comparison (consultancy phase)

- Drafting of detailed, functional analysis

- Software development

- Testing management

- Release and follow-up

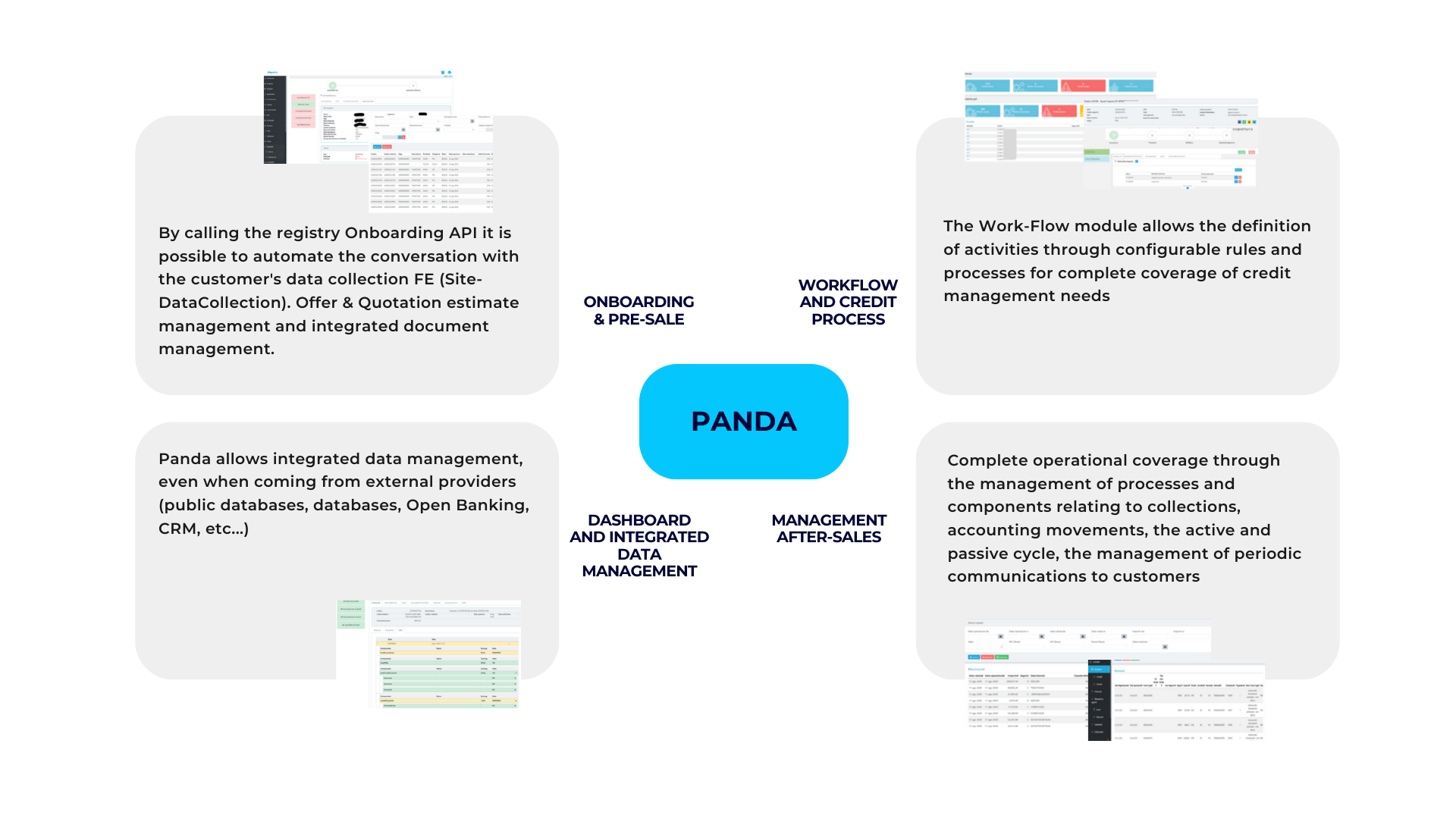

Panda

The solution covers the entire process of customer data management through to supervisory reporting, including all compliance requirements: AUI, ARF, transparency, supervision, anti-usury.

The solution covers the entire process of customer data management through to supervisory reporting, including all compliance requirements: AUI, ARF, transparency, supervision, anti-usury.

The system is based on a microservices architecture, with the back end developed in Java, and the front end developed in Angular.

Of particular relevance is the methodological setting of the trend monitoring focused, in addition to breakage protection, on the complete and scrupulous application of criteria defined by the most recent Italian and supranational regulations regarding defaults, as well as use of expert automated early warning systems with an architecture based on particular connections between mathematical and statistical references and new empirical/experience-based evaluation logic of credit/financial risk events.

FUNCTIONAL COVERAGE

Onboarding

- Integration of Customer Data Collection

- Integration with public databases, data banks, scoring

- Integration with sales support and CRM

General register

- Prospect management

- Integrated customer position card

- Relationship management

- Unified data management (customers, suppliers, CTP, etc.)

- Relationship management

KYC & ADV

-

Management of the process of adequate verification and compliance with regulations

Quote

- Management of prospect offers

- Management of financial condition exceptions

- Integrated document management

Underwriting and resolution workflow

- Management of the underwriting and resolution process

- Alert management

- Event management

- Activity management

- Deadline management

Contractual set

- Printing

- Digital signature

- Compliance storage

Collections & Payments

- SCT

- SDD

- SEDA

- SWIFT

- Sanction

- Placement

Accounting

- Movement

- Account management

- Account statements

- Inventories

- Accounting records

- General ledger

- Books

- Trial balance

- Financial statement

Post-sale management & monitoring

- Credit monitoring

- Collections management

- Customer Service process management

- Periodic customer communications

- Reports

Compliance & Regulatory Reporting

- Management of Regulatory

- Compliance AUI (Anti-Usury Authority)

- ARF (Anti-Money Laundering Reporting)

- Bankit Surveillance

- Anti-usury

Do you need advice?

Our clients are the protagonists: our solutions are totally customizable to your actual needs and requirements.

Contact us for additional information

Innovation

We bring the future forward with our innovative digital solutions, to help you simplify the most complex operations.

Find out more

Careers

At Finwave, we don’t hire people based solely on their CVs. Education and experience are important, but so is the desire to gain new experiences and improve: we are looking for people open to challenges and ready to grow as part of a team. Explore our career opportunities and join the Finwave Group’s talent community!

Discover the Finwave experience

Case History

Nel corso degli anni abbiamo collaborato con centinaia di aziende.

Ogni progetto ha avuto la sua storia, i suoi successi, i suoi obiettivi, i suoi protagonisti.

Eccone alcuni.

AM Consumer Credit platform

In 2019, the customer announced the tender for the three-year outsourcing assignment of the Application Maintenance service.

Learn more

Consumer Credit platform projects and evolution

In the big transformation project that the customer is involved in, a fundamental part is the management of large volumes of projects linked to the Mainframe.

Learn more

New consumer credit platform

The goal of the project is to activate a new legal entity operating in the Consumer Lending sector (to start in 2021).

Learn more

Need more information?

One contact is enough to innovate your business.

We invite you to read the marketing information.